More evidence that Gen Z is changing to chat platforms for just about whatever, including banking, emerges today in the news that Zelf, a fintech start-up offering neobank-style services, is producing buzz amongst Gen-Zers in Spain and France. Its capability for users to interact exclusively by means of messaging has actually seen the start-up hit over 260,000 card pre-orders because its launch in early April, according to the company, which is specifically targeting Gen Z.

They are not alone. Other players in the “banking services through a messaging” space include Kotak Mahindra Bank in India (on WhatsApp) and ICICI in WhatsApp (India). Neither of these can do real provisioning of the card and addition to Apple Pay and Google Pay in the messengers, which is what Zelf can do.

They are not alone. Other players in the “banking services through a messaging” space include Kotak Mahindra Bank in India (on WhatsApp) and ICICI in WhatsApp (India). Neither of these can do real provisioning of the card and addition to Apple Pay and Google Pay in the messengers, which is what Zelf can do.

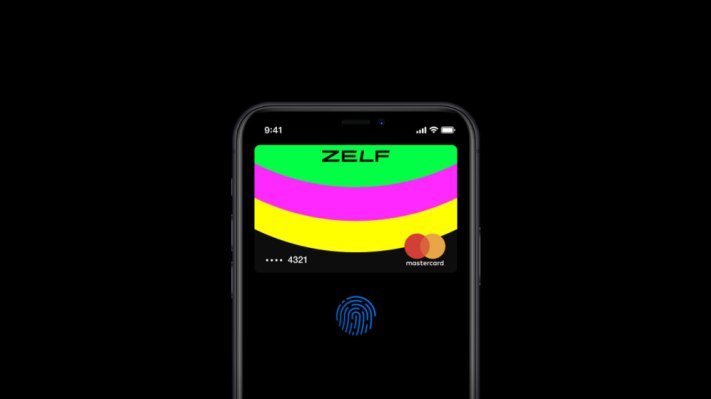

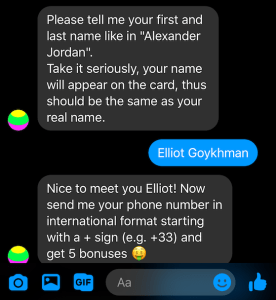

With Zelf, users get an account and a virtual card through their Facebook Messenger, WhatsApp, Viber and Telegram accounts. For offline and online purchases Zelf supports Apple Pay and Google Pay. Users then get a virtual Mastercard debit card readily available in their preferred messenger app.

Part of the reason Zelf is confident it can scale is that it has signed a deal with Treezor, a Banking-as-a-Service platform based in France. Treezor is a fintech, signed up with the ACPR, and was gotten in 2019 by the Société Générale group.

Elliot Goykhman, founder and CEO of Zelf, tells me: “With 84%of screen time taken by 5 apps, mostly messengers, we make sending and receiving money as simple as sending out a message.

The business design for Zelf will come from interchange charges, premium account charges and– toward completion of this year– from loans, charge card and voice memo-activated billings.

TechCrunch.