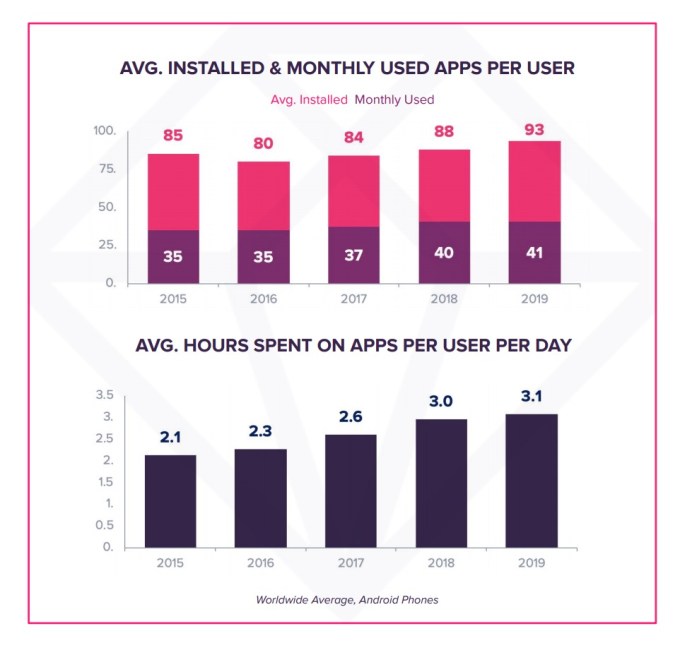

Mobile consumers are downloading and utilizing more apps than ever before. According to recent information from App Annie, mobile users now have 93 apps on their phone as of the end of 2019, up from 85 apps at the end of2015 They likewise now use around 41 apps per month, up from 35 in2015

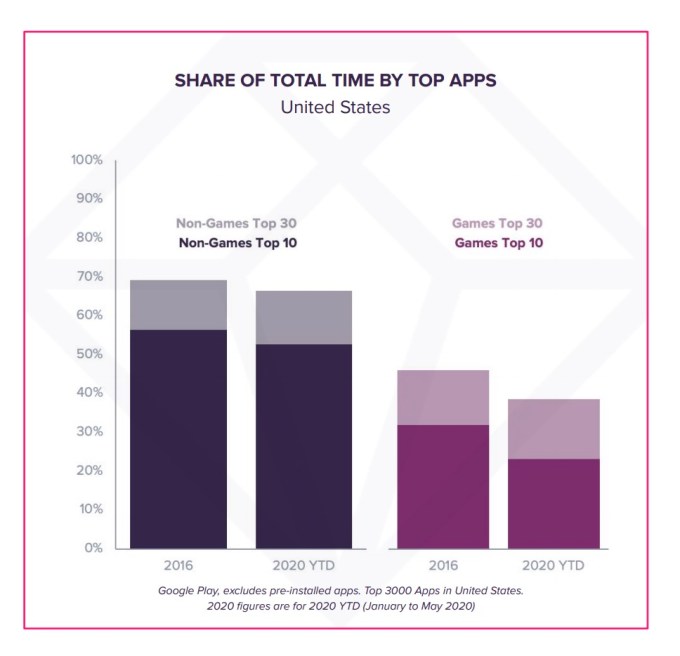

But with that growth has actually also come increased variety among the leading apps, the report found. That means leading apps now comprise a smaller sized percentage of consumers’ total time spent in apps, compared to five years earlier.

Image Credits: App Annie

It’s worth noting that this report was commissioned by Facebook, App Annie says, with an objective of using a more comprehensive look at the developing app ecosystem over the previous 5 years. The report aims to figure out how development is playing out in terms of popular app categories, amongst the top publishers, and how rapidly recently successful apps are attaining substantial growth.

Facebook, in the past, had actually produced this sort of market research data first-hand by way of its Onavo VPN application– now shuttered over privacy issues– and other similar efforts.

Turning to App Annie’s data team is simply a brand-new method for the business to get at the very same sort of information.

App Annie’s market analysis, in part, is similarly derived by method of third-party apps. The business got Distimo in 2014, and as of 2016 has run the VPN app Phone Guardian under the Distimo brand name. It also obtained Mobidia in 2015 and has operated My Data Manager (now on the App Shop under Distimo). Both apps divulge their relationship with App Annie and describe that the apps are utilized for marketing research purposes, with specific examples of the type of information gathered.

The brand-new report’s findings may not be all excellent news for Facebook and other top app publishers. As the app economy progressed, users now have more places to spend time on mobile.

Image Credits: App Annie

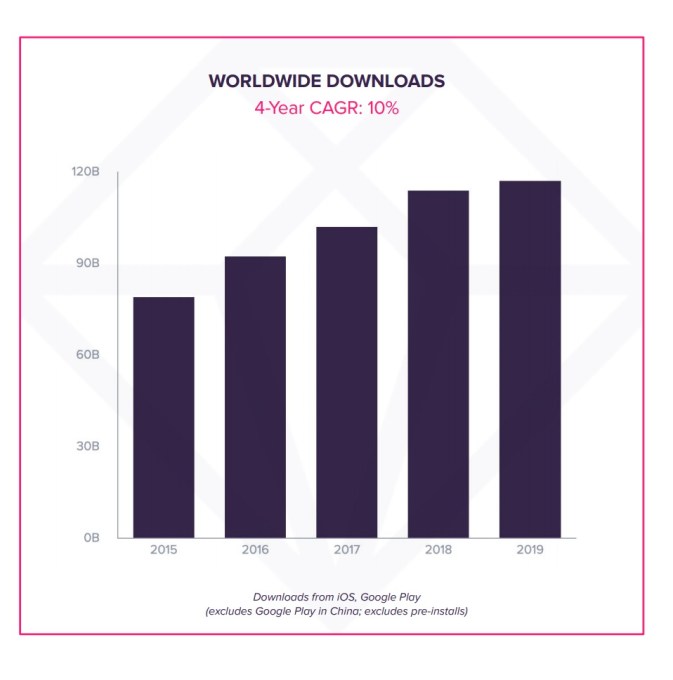

Over the previous five years, around the world downloads continued to grow to reach a record of 120 billion in 2019, with a number of key nations now driving growth, including India (10%year-over-year growth in 2019), Brazil (9%), Indonesia (8%) and Russia (7%).

Downloads in mature economies also struck record levels in 2019, including the U.S. (123 billion), Japan (2.5 billion), U.K. (2.1 billion), South Korea (2 billion), Germany (1.9 billion), and France (1.9 billion).

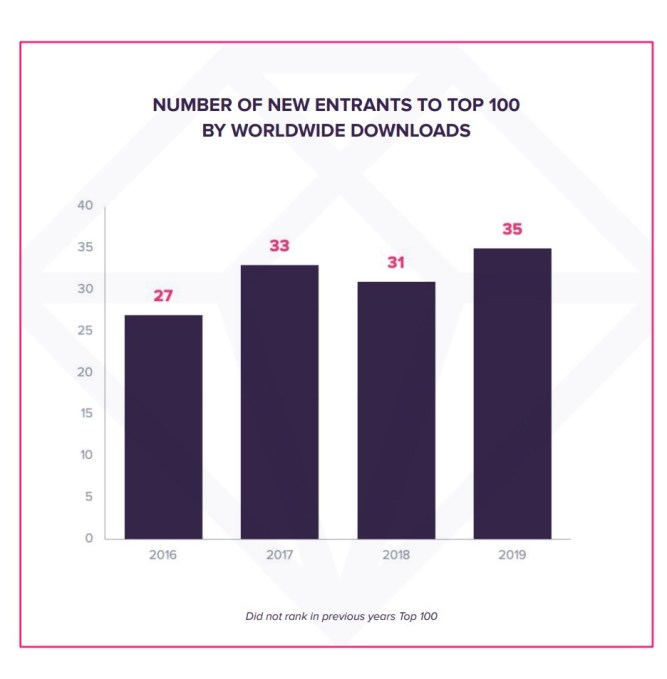

As users grew their time in app to 3.1 hours each day, they also started to use more of a range of apps. According to the report, 35 of the top 100 apps were new entrants in 2019, up from 27 in 2016 across classifications that included social, photography, video, interactions, entertainment and more.

Image Credits: App Annie

This is likely uneasy data for leading app publishers, like Facebook, which has for years preserved a suite of leading apps, consisting of not only its flagship app, however also Instagram, Messenger and WhatsApp As the competitive pressure increases, these top apps make up a smaller percentage of the time spent on mobile devices as users have actually grown more comfy trying newbies– particularly throughout video gaming, home entertainment and video classifications.

The top 30 non-game apps accounted for 69.4%of U.S. users’ total time invested in 2016 amongst non-games. That dropped to 65.5%in 2019, an almost 4 line. Amongst video games, the share fell from 49%to 39%, a 10%drop. (This information was sourced from Google Play in the U.S.)

Image Credits: App Annie

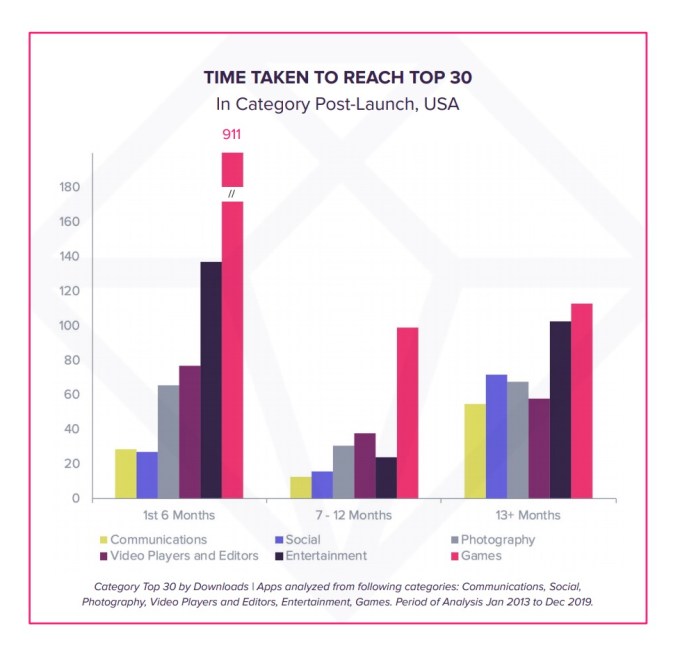

Not only are customers more open up to attempting new apps, the report found that new apps can also rapidly achieve app shop success. In the U.S., for example, more than 60%of apps are able to reach their classification’s Leading 30 in their first 6 months.

This is helped by bigger preliminary marketing pushes along with enhancements in regards to consumer’s devices themselves– like more storage and processing power, which motivates more downloads.

Image Credits: App Annie

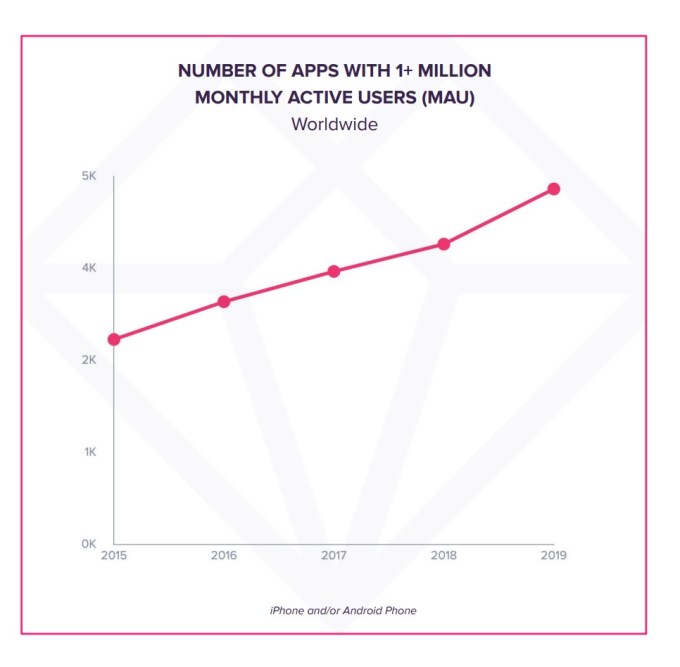

There are likewise more apps capable of attaining the once milestone metric of 1 million monthly active users (MAUs). In 2019, more than 4,600 apps saw 1 million MAUs, including those beyond social and interactions like Netflix, Roku, Disney, CBS, Amazon, Alibaba, Walmart, Target, PayPal, Venmo, Chase, Capital One, Uber, DoorDash, McDonald’s and Starbucks.

Image Credits: App Annie

Image Credits: App Annie

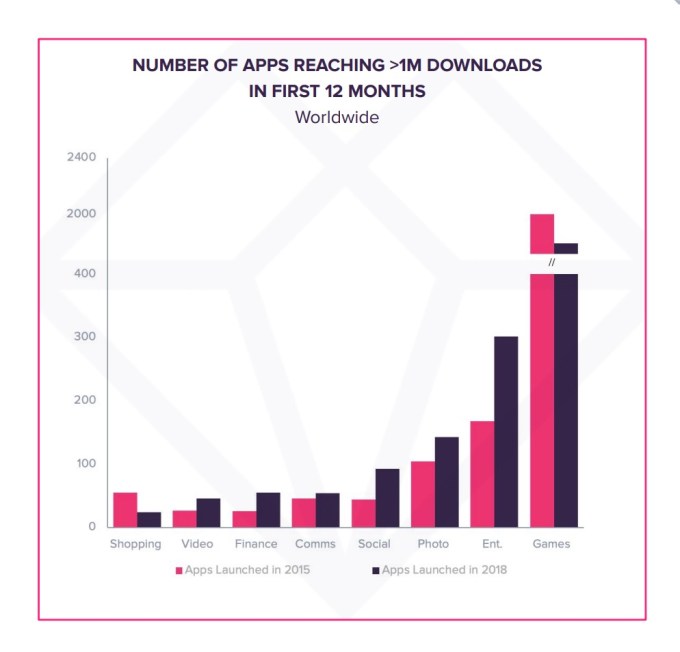

Apps are also attaining the 1 million downloads turning points more quickly, in data examined from 2015 to2018 In the video, financing, interactions, social, image and home entertainment categories, 67%of apps achieved the 1 million downloads turning point within their first 12 months, App Annie says.

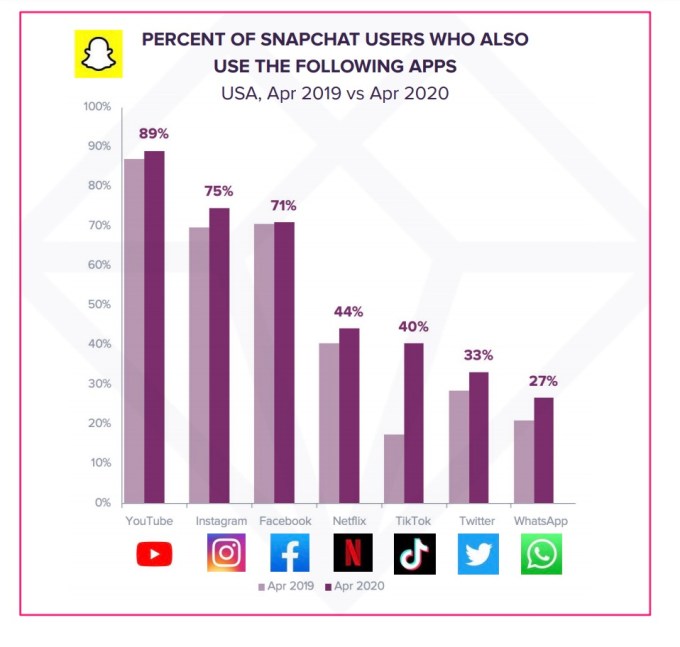

Due to the fact that of the increases, there’s now a great deal of overlap in between top apps. Today, mobile customers will typically pick and utilize several apps within and across classifications to resolve similar requirements, including on social, the report found.

For instance, 89%of Snapchat’s users also utilized YouTube in April 2020 in the U.S., and 75%also used Instagram.

Image Credits: App Annie

TikTok saw the greatest year-over-year increase in cross-app use of Snapchat, rising from 17%in April 2019 to April 2020– an indication of how much it has caught the youth group.

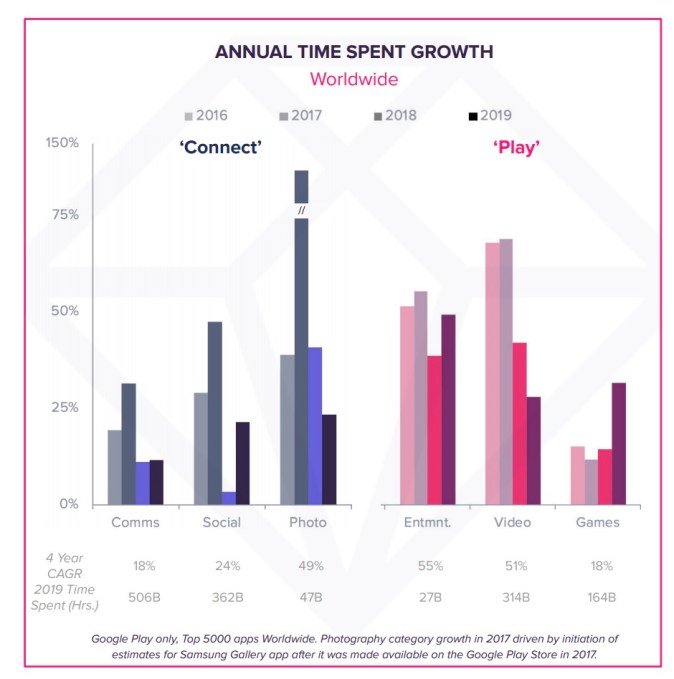

On the other hand, video apps and video gaming are taking up more of users’ time spent in apps. This broad classification of “play”- focused apps represented 22%of the growth in time spent in apps in 2019.

Image Credits: App Annie

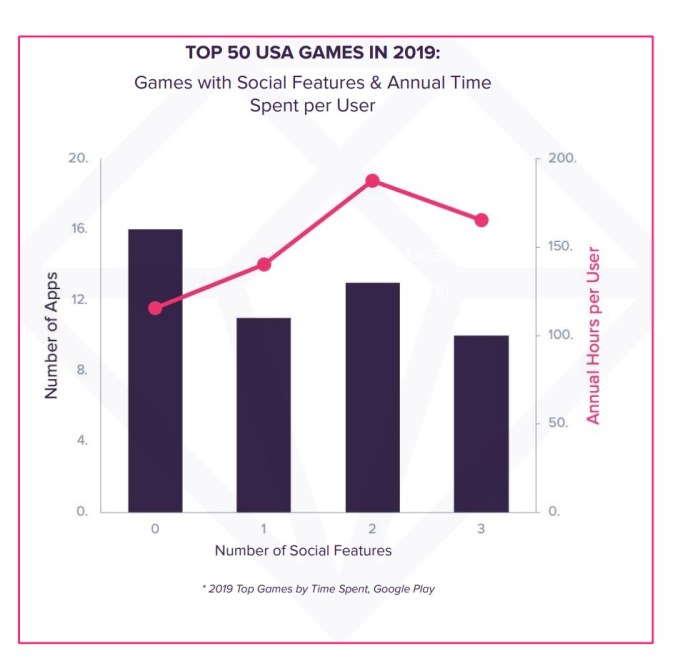

Plus, leading video gaming apps are also executing social features, consisting of Top 50 video games like Fortnite, Clash of Clans, Call of Responsibility: Mobile, Township, Star Wars: Galaxy of Heroes, New Yahtzee with Buddies, Golf Clash and Slotomania.

More than two-thirds of the Top 50 video games have added at least one social function, whether that’s welcoming friend to play, social helps for progressing, guilds or clans or in-app chat. This, in turn, has actually caused gamers spending more time in video games as they can connect with friends there.

Image Credits: App Annie

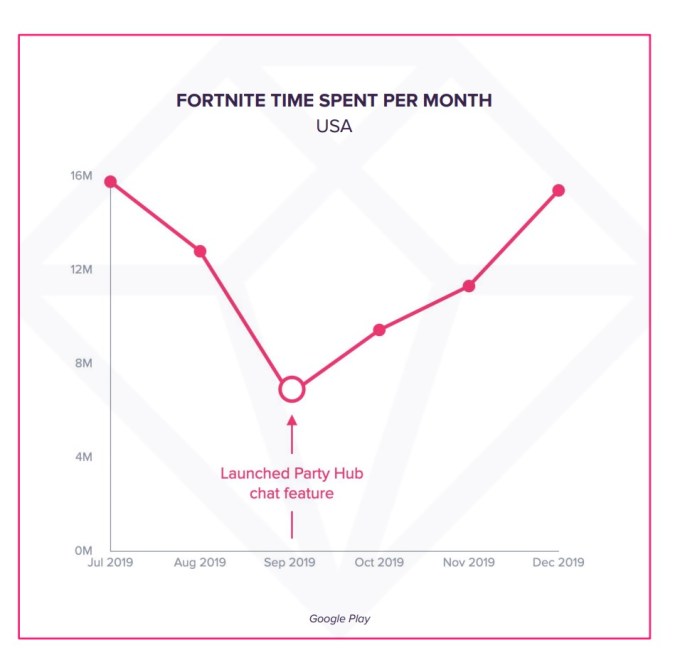

Fortnite, as one crucial example of this pattern, rolled out Party Hub based on its gotten Houseparty innovation, in September2019 In the three months after the rollout, time spent in Fortnite grew 130%.

Image Credits: App Annie

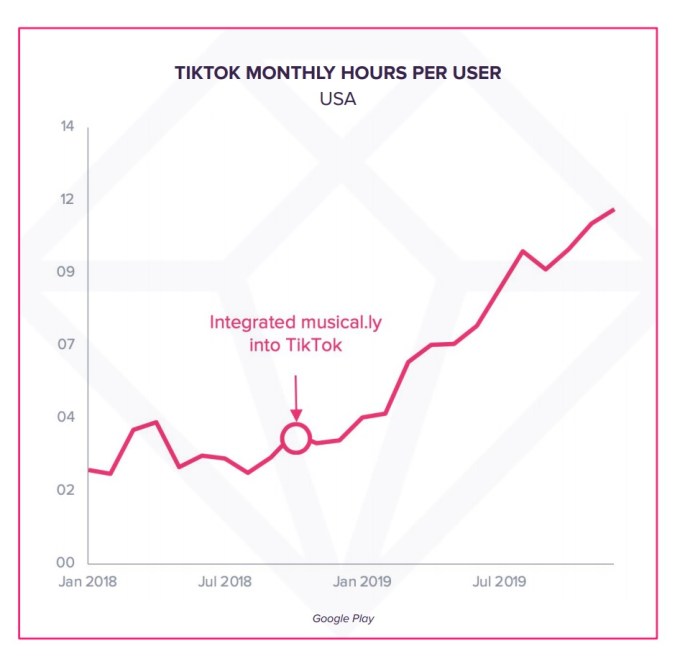

Outside of video games, TikTok has actually increased by blending elements of top categories like social, video and home entertainment. After combining with Musical.ly, it has rapidly rolled out more video editing features and increased ad invest aggressively to grow its user base and drive engagement. By December 2019, U.S. users were costs 16 hours, 20 minutes in the app each month, on average, up from 5 hours, 4 minutes in August 2018.

Image Credits: App Annie (note above chart just showcases Google Play data)

The full report likewise delves into country-by-country breakdowns but, in general, discovered that many nations saw record downloads in 2019 and similar patterns in regards to app usage frequency increases and time invested.

One significant point of comparison is that U.S. users have actually more apps installed than in other markets (97 versus 93), however tend to utilize less apps compared with around the world trends (36 versus 41). They also spend somewhat fewer hours per day in apps, typically, than the worldwide average at 2.7 hours versus 3.1 hours.

” This report reveals that the app market is more competitive today than ever. Brand-new business are succeeding with ingenious apps that meet requires individuals may not even know they have,” said Ime Archibong, head of Facebook’s New Product Experimentation team, an internal team at Facebook looking to discover new designs for social apps.

App Annie’s report is offered upon demand here.

TechCrunch.